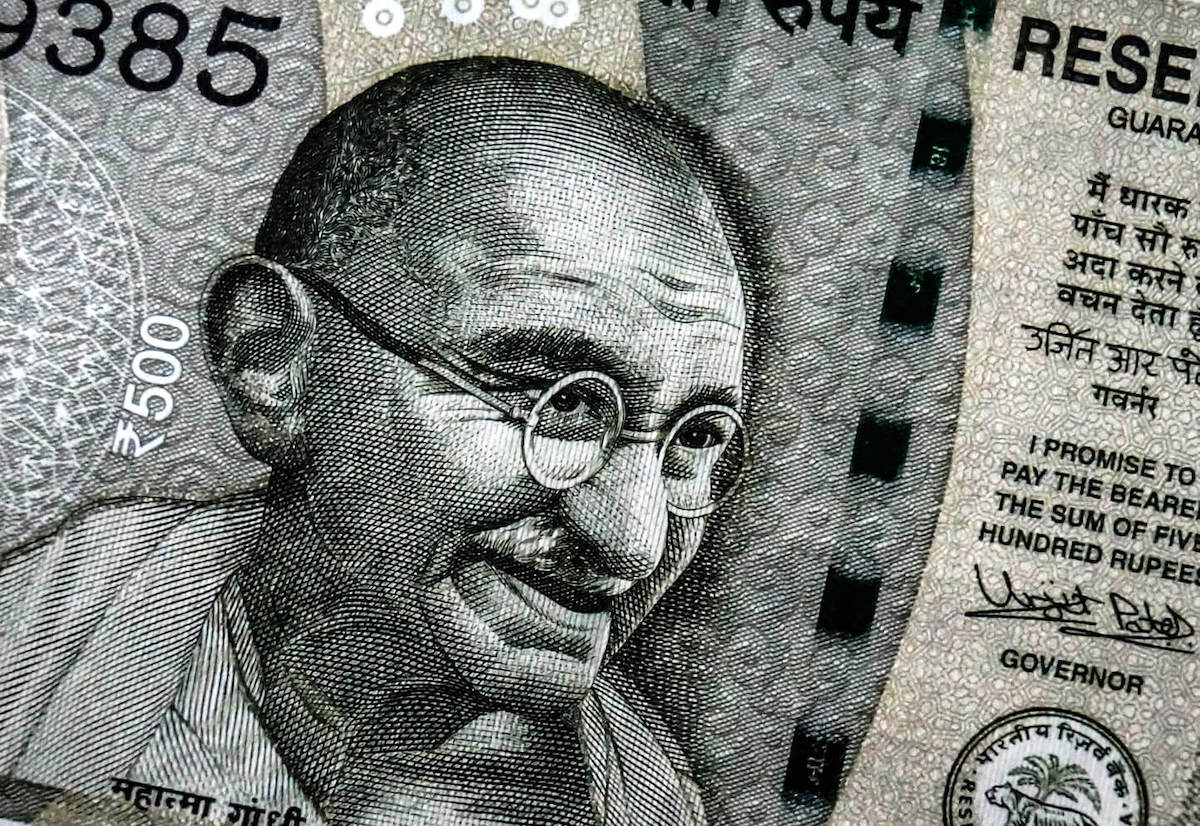

NEW DELHI (WNI) — India has announced it will introduce a central bank digital currency that will be set up in 75 districts and made available through the country’s commercial banks.

The announcement today by Minister for Finance & Corporate Affairs, Smt Nirmala Sitharaman, confirms that India will bring the Digital Rupee to its citizens within the next year.

India’s new Central Bank Digital Currency (CBDC) will lead to a “more efficient and cheaper currency management system” according to Mr Sitharaman.

Among the fastest growing economies in the world, India’s GDP is forecast to grow at 9.2% in 2022, and is moving quickly to bring a new CBDC to its large population of over 1 billion citizens.

India will also support the development of new digital payment ecosystems to bring the country up-to-speed on the adoption of digital payments through all forms of commerce. Proposals have also been brought forward to tax digital asset income at 30%.

India’s move to regulate the cryptocurrency market and launch its own Digital Rupee comes as central banks around the world speed up adoption of digital currencies. China in 2020 launched a CBDC trial with a digital yuan, and is expected to push through a central bank digital currency in the near future. The U.S. and the U.K. are also among several nations planning on launching digital currencies.